This website uses cookies and is meant for marketing purposes only.

Wall Street Futures and gold soared last Wednesday on hopes & hypes of an early Fed pivot/put. The market was expecting -100 bps Fed rate cuts in 2024 and 2025 each (from June 24) and QT tapering from June’24 to close the same by Dec’24. But going by the overall Fed/Powell statements, Q&A comments, trend of core inflation, and also the Nov’24 US Presidential Election, the Fed may go for -75 bps rate cuts in 2024 starting from September after closing the QT by Aug’24. Previously, the market was anticipating Fed rate cuts from June’24. Subsequently, Gold stumbled from around 2222 post-Fed early Thursday to almost 2155 Friday, while Wall Street Futures also slid. Dow Future stumbled from around 40316 to 39500, NQ-100 also slid from around 18707 to 18350 and SPX-500 slips from around 5322 to 5250.

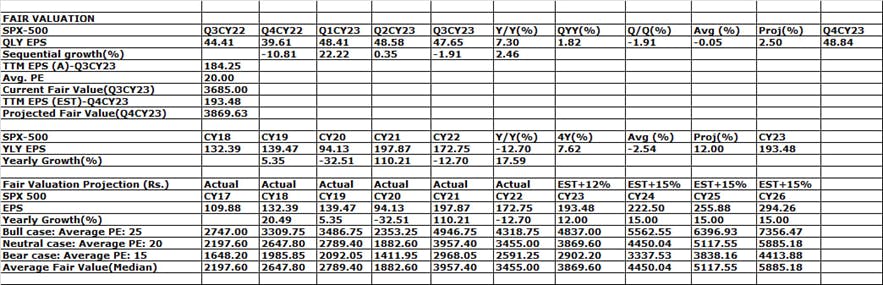

At around 5300 (S&P 500) and TTM EPS 184.25, the current TTM PE of the S&P 500 is now around 28.76, substantially above the mean PE for the last 10 years around 20. Even if we consider projected CY23 EPS around 193.48 and 222.50, the projected PE would be around 27.40 and 23.80. The market may be now discounting projected CY25 EPS around 255.88; forward PE is now around 20.71. The average EPS growth of the S&P 500 is now around +17.50% (~18%) since 2018.

Overall, the stimulus-addicted Wall Street may be trading far ahead of its fundamentals/valuation. SPX-500 gained around +24% in the last year (2023) and +32% in the last three years, but currently may be running far ahead of fair valuation on hopes & hypes of early & deeper Fed rate cuts and AI /tech optimism.

In Q3CY23, the actual S&P 500 (SPX-500) EPS was around $47.65 vs 48.58 sequentially (-1.91%), 44.41 yearly (+7.30%), and market expectations 52.35. Now considering the current run rate, the Q4CY23 EPS may grow sequentially by around +2.50% to $48.84, which may translate the CY23 EPS to around $193.48 against CY22 EPS of $172.75 (+12.00%).

In CY22, the EPS of the S&P 500 was around $172.75 vs 197.87 in CY21 (-12.70%). Now, assuming a +15% CAGR in EPS for CY: 24-26 amid lower borrowing costs (Fed rate cuts), synchronized global reflation/growths, Chinese recovery, and the uptick in consumer spending, SPX-500 may report an EPS of around $222.50-255.88. Further assuming an average fair PE of 20, the fair value of the S&P 500 may be around 4450-5118. As the financial market usually discounts 1Y earnings in advance, the projected fair value of the S&P 500 may be around 4450-5120 by Dec’23-Dec’24; i.e. broad fair valuation range should be now around 4500/4400-5200/5300 if S&P 500 indeed reports EPS as being projected.

On early Wednesday, Dow Futures got some boost after China's President Xi met with more than a dozen American business leaders (CEOs). As per the report, Xi spoke with the US CEOs for over an hour and a half. The U.S. business leaders asked Xi several questions, which the Chinese president answered.

China’s President Xi clarified Wednesday:

· There is no need for a decoupling between Beijing and Washington

· China is neither saturating nor bottoming out; China is steady

· In the past, (China) did not collapse because of a 'China collapse theory' and it will also not peak now because of a 'China peak theory’

· China's development has gone through all sorts of difficulties and challenges to get to where it is today

· China and, the US should respect each other's development, not obstruct it, as that is a ‘win-win situation’ for both and the rest of the world

· Both sides should respect international laws and market rules and expand and deepen mutually beneficial cooperation in trade and economy

· China's development into one of the world's leading economies is a result that the Chinese people achieved, but also one that could not have been achieved without international cooperation

After COVID and the resultant global slowdown, export-heavy China’s economy was under pressure. China's economy is plagued by many problems, including a real estate bust, deflation, debt bubbles, demographic issues winter storm, foreign investor (FPI/FDIs) exodus, supply chain fracturing, deteriorating Sino-US ties, and the list goes on! But despite the China collapse narrative, China’s $18T real GDP has grown around +5.2% in 2023 and is set to grow around +5.5% in 2024.

Despite domestic political compulsion, especially ahead of the Nov’24 US Presidential election, the Biden admin also wants to recoup with China rather than decoupling theory, which was ‘vehemently’ advocated by former President Trump, who is again set to return in 2025 amid anti-immigration, anti-China, anti-war platform with nationalistic narrative.

On Wednesday, Wall Street Futures and gold were also boosted by some boost in bonds after the ‘Steller’ auction of the US7Y YSY bond and ‘hawkish’ desperate jawboning by BOJ/JP officials, talking about an imminent intervention to prevent USDJPY from crossing 155 redlines. USDJPY is now ‘comfortably’ trading above 150 despite hawkish talks by BOJ to increase repo/reverse repo rate as the market may no longer believe BOJ (Bank of Jokers/Japan) words.

A 34-year low was broken by the JP yen due to rumors that Japanese authorities were getting ready to step in and help the currency. In their first three-way meeting since late May, representatives from the Financial Services Agency, the Bank of Japan (BOJ), and the Japanese Ministry of Finance convened to talk about markets. After the meeting, Kanda, Japan's top currency official, stated that he believes speculative moves are to blame for the yen's decline and promised to take proper action against extreme swings.

BOJ/Japan are still trying to stabilize the currency with jawboning rather than real policy action of hiking repo rate from currently +0.30% to at least +3.00% over the next 2-3 years to reduce policy differential with US/Fed/USD and even ECB/EU/EUR. As Japan continues to pay around 11-15% of core tax revenue as interest on public debt, it would be very difficult for Japan/BOJ to hike rates in line with the Fed as bond yield; i.e. government borrowing cost will further soar in that scenario.

In any way, on Wednesday, export-heavy Wall Street Futures (DJ-30, NQ-100 and SPX-500) got some boost on lower USD and also Q1 (QTR) end portfolio rebalancing. Late Wednesday, global rating agency S&P Global affirmed an AA+ rating for the US with a stable outlook:

· U.S. 'AA+/A-1+' Sovereign Ratings Affirmed by S&P; Stable Outlook Remains

· U.S. outlook stable expects continued economic resiliency with effective monetary policy

· US: Monetary Policy Credibility and International Reserve Currency Status of USD Provide Immense Policy Flexibility

· Expects net general government debt to exceed 100% of GDP in the next three years

· Expects U.S. Economy to Grow Around 2% in Medium Term

· Passage of Short-Term Continuing Resolutions Assumed to Avert Government Shutdown During Campaign Period After September

· Predicts US to rely more on incentives than sanctions for promoting energy transition and climate change policies

· Pandemic stimulus withdrawal and higher rates slow recent economic rebound

· Ratings constrained by fiscal weaknesses, namely high net general government debt and deficits

Like Japan, the US is now also paying around 15% of its revenue as interest on public debt against 10% for the last few years when the US interest rate was low. Thus Fed has to cut rates in the coming months/years to bring surging US borrowing costs lower.

On late Wednesday, Fed’s Waller said:

· Still, no rush to cut rates in the current economy

· May need to hold a current rate for longer than expected, no rush to cut

· The US economy supports the Fed's cautious approach

· Unclear if Neutral Rate Has Changed

· Dollar Reigns Supreme as Currency

· The economy has supported the cautious approach by the Federal Reserve

· The economy does not warrant major rate cuts by the Fed

· The economy is not giving the Fed a case to pursue big rate cuts

· We would need a dramatic change in the inflation picture to hike

· A case for hiking rates is very remote

· Expects Inflation Pressures to Wane

· If unemployment goes up no reason to panic

The 6M rolling average of US core inflation (PCE+CPI) is now around +3.6%. Fed may cut 75-100 bps in H2CY24 if the 6M rolling average of core inflation (PCE+CPI) indeed eased further to +3.0% by H1CY24.

As per Taylor’s rule, for the US:

Recommended policy repo rate (I) = A+B+(C-D)*(E-B)

=1.50+2.00+ (2.60-2.00)*(4.50.00-2.00) =1.00+2+ (0.60*2.50) = 3.00+1.50=4.50% (By Dec’24)

Here:

A=desired real interest rate=1.50; B= inflation target =2.00; C= Actual real GDP growth rate for CY23=2.6; D= Real GDP growth rate target/potential=2.00; E= average core CPI+PCE inflation for CY23=4.50

Fed may announce a plan for QT tapering/closing in the May meeting and should close the same before going for rate cuts in H2CY24. Fed, the world’s most important central bank may not continue QT (even at a reduced pace) and go for rate cuts at the same time as QT, and rate cuts are contradictory, although Fed/Powell kept the option open, at least theoretically.

Fed’s B/S size is now around $7.54T (as of 13th Mar’24), reduced from around $8.96T life time high scaled in Apr’22. Looking ahead, the Fed may maintain its B/S size around $7.00T, which would be 25% of the projected CY24 nominal US GDP of around $28T. Fed had indicated previously (before COVID) that B/S size is around 20% of nominal GDP. In Sep’2019, QT tapering (started in 2017) caused B/S size to fall to around $3.77T from around $4.47T, which caused severe disruption in the US money/funding market, forcing the Fed to go for small QE even before COVID.

Now Fed’s QT rate is $95B/M; i.e. $0.095T/M; if Fed intends to keep its B/S size around $7.00T from the existing $7.54T, it needs around 5-6 more months at the same rate of $0.095T/M; i.e. by Aug’24, Fed may be able to reduce its B/S size to around $7.00T and stop the QT. In that scenario, the Fed may go for -75 bps rate cuts in September, November, and December’24. By 18th September (Fed MPC date), the Fed will have complete data for core inflation and also unemployment/real GDP data till Aug/July’24 to have the required ‘higher confidence’ to go for rate cuts.

After the 2019 money/funding market crisis/disruptions caused by QT, the Fed introduced the ON RP/RRP lending facility (Overnight Repo and Reverse Repo Repurchase Agreement) to ensure financial stability even during QT periods, which generally causes less intention among big banks/MMFs (money market funds) to lend each other. Thus, this time QT was not disruptive like we saw in late 2019 causing some slide in Wall Street and making Trump furious against Fed/Powell.

Looking ahead, Fed may keep B/S size around $7.00T, at mid-2020 levels during COVID times to ensure financial/Wall Street stability along with Main Street stability (price stability and employment stability).

Ahead of the Nov’23 U.S. Presidential election, White House/Biden/Fed/Powell is more concerned about elevated inflation rather than the labor market; prices of essential goods & services are still significantly higher (around +20%) than pre-COVID levels, which is creating some incumbency wave (dissatisfaction) among general voters against Biden admin (Democrats).

Thus Fed is now giving more priority to price stability than employment (which is still hovering below the 4% red line) and is not ready to cut rates early as it may again cause higher inflation just ahead of the November election. Fed may hike only from Septenber’24, which will ensure no inflation spike just ahead of the Nov’24 election (as any rate action usually takes 6-12 months to transmit in the real economy), while boosting up both Wall Street and also Main Street (investors/traders/voters). Fed hiked rate last on 26th July’23 and may continue to be on hold till at least July’24; i.e. around 12 months for full transmission of its +5.25% cumulative rate hikes effect into the real economy.

Overall, the Fed’s mandate is to ensure price stability (2% core inflation), and maximum employment (below 4% unemployment rate) along with financial/Wall Street stability as well as lower borrowing costs for the government. As the US is now paying almost 15% of its tax revenue as interest on debt, the Fed will now not allow the 10Y US bond yield above 4.50-5.00% at any cost.

Bottom line:

Fed may not continue QT (even at a lower pace) and go for a rate cut cycle at the same time as these two policy actions are contradictory. Thus Fed may opt to first close the QT by Aug’24 at a B/S size of around $7.00T from the present $7.54T through the present pace of $0.095T/M. Then the Fed may go for rate cuts of -75 bps cumulatively in September, November, and December’24 for +4.75% repo rates from the present +5.50%. Fed is now using ON RR/RRP for funding market stability, especially for smaller/regional US banks (around 10% of the US banking system), there is no visible effect of QT unlike during late 2019. Thus Fed may opt for direct QT closing at the present pace by Aug’24, keeping the B/S size around $7.00T, almost 25% of the estimated nominal GDP ($30T) by 2024.

Market wrap:

On Wednesday, Wall Street Futures surged on China and QTR end portfolio rebalancing boost; but Gold stumbled late hours after hawkish jawboning by Fed’s Waller. In this way, the blue-chip Dow Jones (DJ-30) surged 478 points, led by Apple and Intel. The S&P 500 added 0.8% to close at a record high, snapping a three-day losing streak. The Nasdaq added 0.4%, held back by losses from the AI giant Nvidia. Wall Street was boosted by utilities, real estate, and industrials, while tech underperformed. Among the mega-cap stocks, Apple, Amazon, Tesla and Intel surged, while Nvidia dragged. Merck jumped after the US FDA approved the use of its Winrevair drug. Additionally, Trump Media & Technology's shares soared, making Trump among the world’s richest person, just the opposite from a few years back.

Technical trading levels: DJ-30, NQ-100 Future, and Gold

Whatever may be the narrative, technically Dow Future (40120), now has to sustain over 40700 levels for any further rally to 42600 levels in the coming days; otherwise, sustaining below 40650-40450/40300 may again fall to 39250/38700-38200/37950 levels in the coming days.

Similarly, NQ-100 Future (18500) now has to sustain over 18850 levels for any rebound towards 19000/19200-19450/19775 and 20000/20200 in the coming days; otherwise, sustaining below 18800-18700, NQ-100 may gain or fall to around 18000/17500-17200/16875 in the coming days.

Also, technically Gold (XAU/USD: 2189) now has to sustain over 2205 for any further rally to 2225/2250-2275/2300; otherwise sustaining below 2200/2195-2190, may fall to 2175/2145*, and further to 2120/2110-2100/2080-2060/2039 and 2020/2010-2000-1995/1985-1975 and even 1940 may be on the card.

The materials contained on this document are not made by iFOREX but by an independent third party and should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.