This website uses cookies and is meant for marketing purposes only.

The dollar returns to gains on Thursday, with the dollar index (USDX) posting a moderate increase of 0.22% and closing in once again to five-month highs. According to reports, this move was supported by solid data reported from the U.S. as manufacturing activity in the U.S. Mid-Atlantic region expanded by the most in two years and as Philadelphia Fed's monthly business conditions index exceeded forecasts indicating further optimism among economists.

Further support on the dollar came from safe haven demand that rose early on Friday, following a missile strike from Israel to the Iranian province of Isfahan, a site of significant nuclear facilities. According to reports this was likely a warning from Israel that it could easily overwhelm Iran's defenses.

With recent developments in the economic, political and geopolitical fronts, bets for the first rate cut to occur in June rose marginally for yet another session, from 16.5% to 17.9% according to CME Group's FedWatch tool.

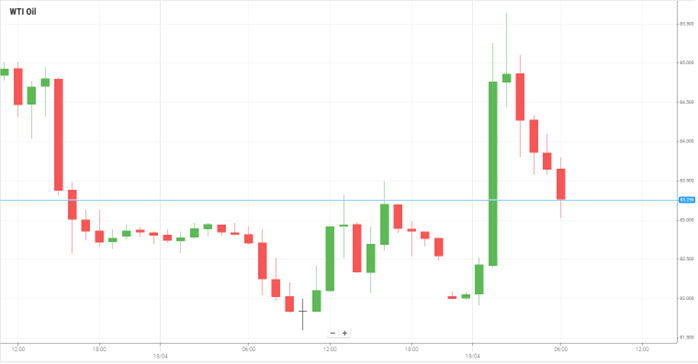

In other news, the two main crude oil benchmarks WTI and Brent surged early on Friday, as reports that Israel had attacked Iran raised concerns over possible supply disruptions in the Middle East. WTI and Brent are both trading close to 1.3% higher as of Friday 07:30 AM GMT after hitting gains of almost 4.3% earlier in the session. Another factor that adds pressure on supply is the announcement of the US that sanctions will most likely be imposed on Iran, another OPEC member, after the country's drone strike on Israel.

On the cryptos front, market participants are on edge, eagerly waiting for the bitcoin 'halving' that is due to take place in early hours of Saturday. The halving which happens roughly every four years is an underlying technology designed to cut the rate at which new bitcoins are created. The overall cryptocurrency market currently stands at a market capitalization of 2.46 trillion with market participants and blockchain usage rising at an extremely high rate in the last month.

The EUR/USD pair ended the session on Thursday 0.25% lower ending the session just above the level of 1.0640. The dovish comments by ECB policymakers and strong US data endorsing the Fed’s “higher for longer” outlook have weighed the pair.

Earlier today ECB’s Vice-President Francoise Villeroy, affirmed that, barring a major surprise the bank will cut rates in June. These words have been echoed by the Governor of the Austrian central bank Robert Holzmann.

In the US, macroeconomic data has endorsed the picture of a strong economy with a tight labour market. Jobless claims remain steady at relatively low levels while a manufacturing activity gauge has reached its best reading in two years.

Safe-haven gold gained on Thursday as persistent tensions in the Middle East added to the metal's appeal despite robust economic data from the U.S. that raised prospects of fewer interest rate cuts.

In the Middle East, Israel has signalled it will retaliate to a volley of attacks from Iran despite calls for restrain from Western countries but has not said how. Multiple media reports, including those from Iranian news agencies, show explosions across several parts of Iran, Syria, and Iraq. Multiple U.S. news outlets reported U.S. officials saying that Israel had struck back against Iran over an attack last week. Bullion's upside came despite data showing U.S. weekly jobless claims were unchanged at low levels last week.

Oil prices retreated on Thursday as investors weighed mixed U.S. economic data, U.S. sanctions on Venezuela and Iran and easing tensions in the Middle East. The tension in the Middle East came back on Friday and oil prices rose sharply after Iranian news agencies reported several explosions across the country, indicating potential strikes by Israel. Iran's Fars News Agency said on Friday that explosions were heard in Isfahan in central Iran, in parts of southern Syria and in parts of Iraq. ABC news reported that U.S. officials said Israel had retaliated against Iran.

Israel's potential retaliation marks an escalation in the Middle East conflict and saw market participants racing to reintroduce a risk premium back into oil prices.

U.S. stocks traded between gains and losses on Thursday, swinging from red to green and back as investors contended with the push-pull of a strong economy and restrictive Federal Reserve policy. All three major U.S. stock indexes ended the session on Thursday with loosses.

Economic data released on Thursday painted a mixed picture, with low jobless claims and solid factory data versus weaker-than-expected home sales and leading economic index readings.

Netflix fell nearly 5% in aftermarket trade after the video streaming giant’s second-quarter revenue outlook missed estimates, largely overshadowing a bumper first-quarter report. The first-quarter earnings season is set to pick up pace in the coming days, with reports from Procter & Gamble Company and American Express Company due later today.

The materials contained on this document should not in any way be construed, either explicitly or implicitly, directly or indirectly, as investment advice, recommendation or suggestion of an investment strategy with respect to a financial instrument, in any manner whatsoever. Any indication of past performance or simulated past performance included in this document is not a reliable indicator of future results. For the full disclaimer click here.

Join iFOREX to get an education package and start taking advantage of market opportunities.